Download Now

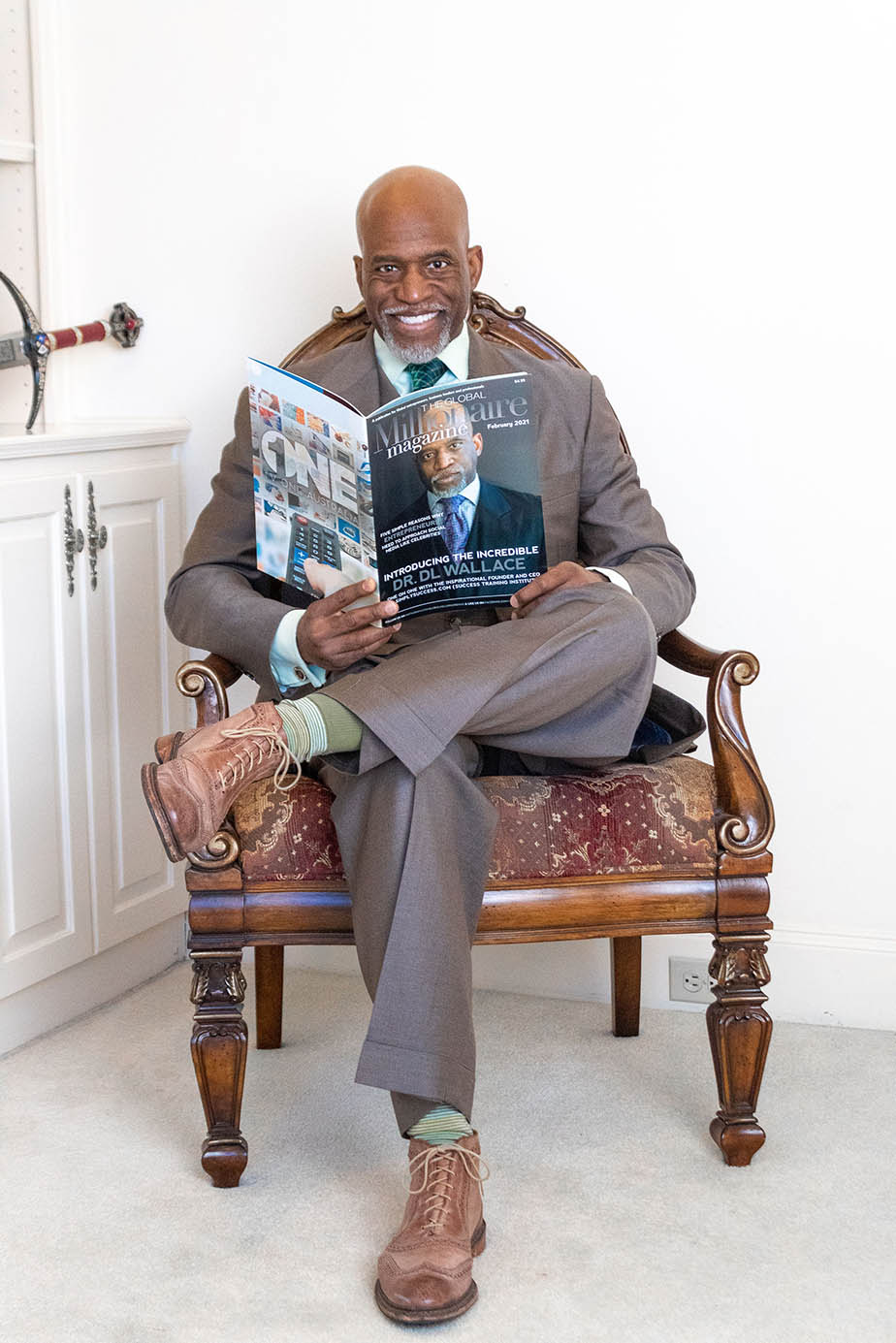

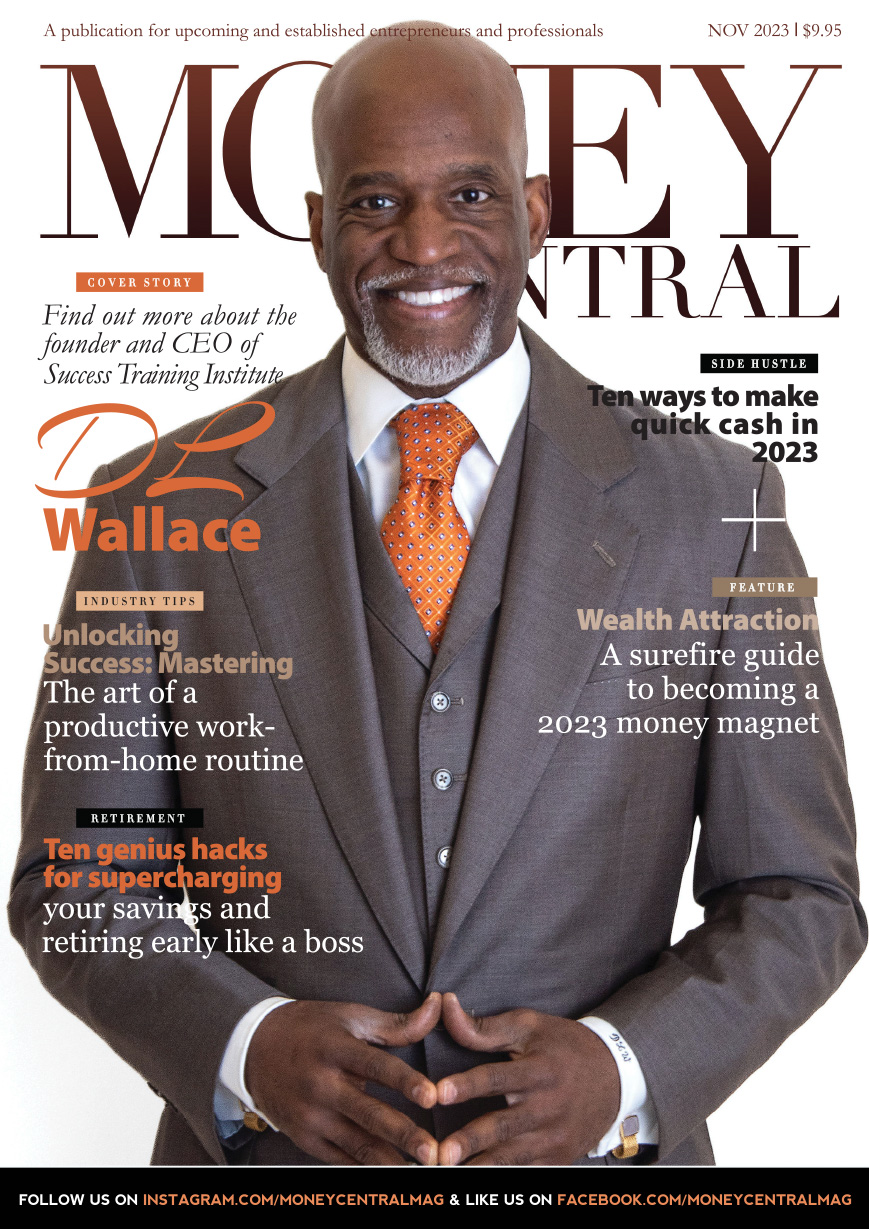

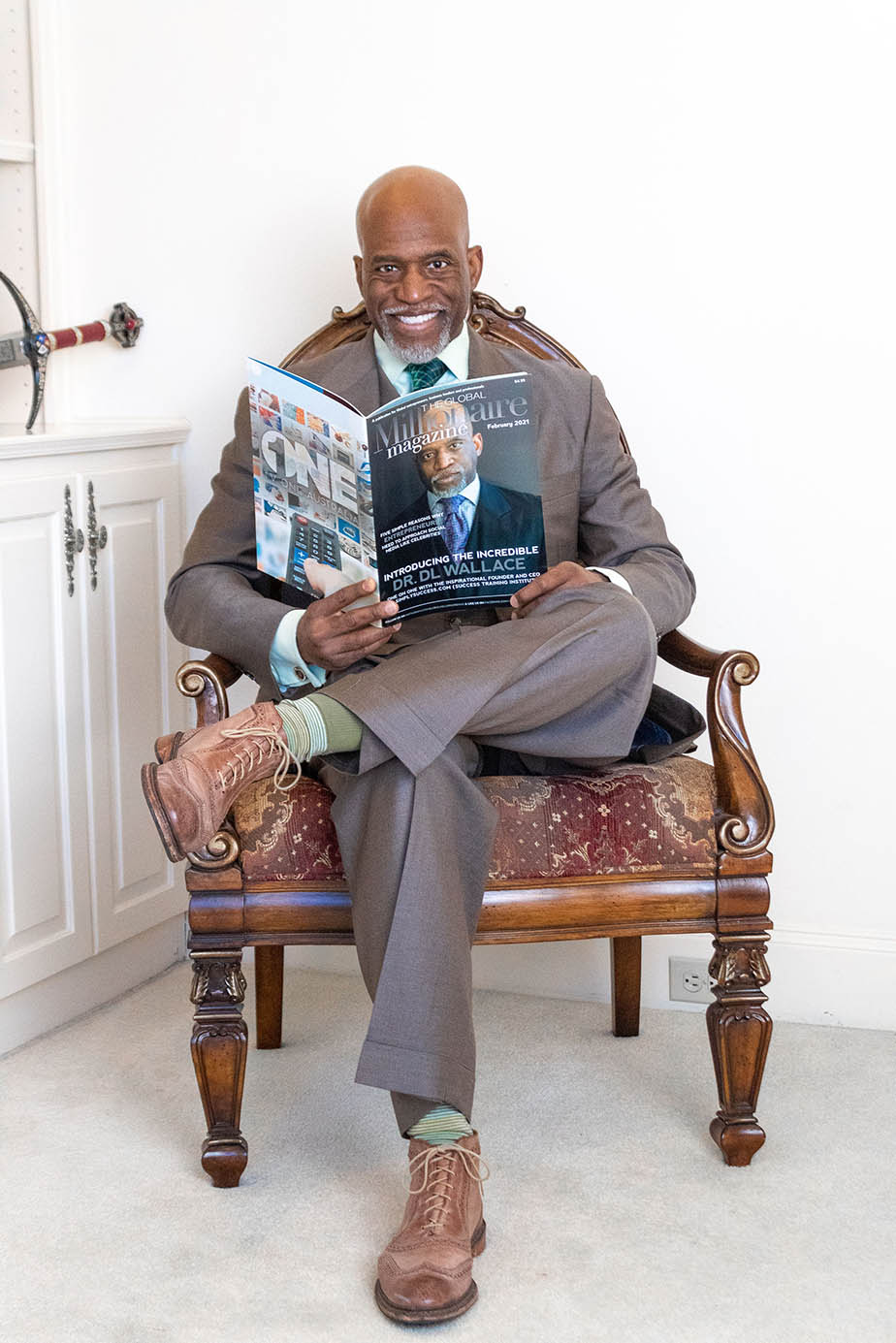

In the ever-evolving landscape of the modern workforce, the importance of soft skills cannot be overstated. Dr. DL Wallace, a seasoned expert in the field of Soft Skills Training and Development, has been spearheading a paradigm shift in employee development, entrepreneurial growth, organizational efficiency, and business strategy for over two decades. His journey as the CEO and Founder of Success Training Institute (STI) has not only transformed individuals and organizations but has also earned him global recognition in the education technology sector.

Dr. Wallace’s brainchild, Success Training Institute, has emerged as the world leader in superior soft skills training. Established in 2012, this award-winning education technology company, headquartered just north of Dallas, Texas, has been the driving force behind a transformative learning experience. STI’s clientele spans colleges, universities, workforce commissions, school districts, and corporations across diverse industries.

What sets STI apart is its commitment to personalized learning. Their tailored platforms offer pre and post-assessments, individualized learning plans, and access to data and analytics, enabling learners to chart their growth path comprehensively. The institute’s range of services caters to both individuals and corporations, providing essential training in compliance, leadership, problem-solving, team building, customer service, and more.

Success Training Institute offers a variety of plans tailored for entrepreneurs, college students, sales professionals, HR experts, and many more. Their programs are designed to accommodate nearly any budget, offering rapid certification programs that yield tangible results within weeks, with immediate improvements in productivity, positivity, and efficiency. The cornerstone of their training approach is a series of power-packed, 8-minute video segments that can be consumed on-demand, making it accessible for employees at all levels.

Moreover, STI is not only bridging the gap for current employees but also laying the foundation for future professionals. Their Virtual Internship Programs offer college students the chance to enhance their post-graduation employability. These students earn valuable soft skills certifications, strengthening their resumes and gaining opportunities to work remotely while supplementing their college expenses.

The impact of Success Training Institute extends far beyond traditional learning. As a Top Innovator in Education Technology, STI’s commitment to original content, unique instructional methods, and an evergreen library is fundamentally changing the professional development landscape for students and companies alike. Dr. DL Wallace’s vision has given rise to a transformative force that is equipping individuals and organizations to thrive in the fast-paced, ever-changing world of work.

MoneyCentral Magazine recently had the privilege of engaging in a candid conversation with Dr. DL Wallace, delving into his remarkable journey and the profound impact of Success Training Institute. Here’s what transpired in this exclusive interview:

What inspired you to focus on soft skills training, and how did you embark on this journey?

Several years ago, when I owned another company, I noticed our new hires’ challenges with many of the soft skills basics. Keep in mind that these new hires were all college grads, and yet they had difficulty maintaining focus, collaborating with others, managing time, and resolving conflict. We had two options: Develop a viable training system or keep replacing people. Of course, replacing people may be more convenient, but training them is a much better investment. We chose to train them. I began developing a soft skills curriculum, and we started with early morning training calls that were only 8 minutes per day. Why 8 minutes? It fits the hectic schedules of our team. Soon, we noticed remarkable improvements just by elevating the soft skills of our employees. Other companies started asking if we could do the same for them, and the rest is history.

Can you share some success stories or testimonials from individuals or organizations that have benefited significantly from Success Training Institute’s programs?

My favorite part of this business is hearing the powerful testimonials from our clients. We even post quite a few of them online. One story that sticks out to me most is from a single mother from South Carolina. Her daughter was enrolled in college and was off to a bad start. Not making friends, poor grades, and losing confidence. She begins taking our soft skills courses, just a few daily lessons from her phone. She started with Adaptability and Work Ethic. According to her mom, she went from dropping out and returning home to making the Dean’s List her freshman year! We hear these stories all the time because college and career success are based on well-developed soft skills. All the research proves this, and it’s great to see it happening. Most students don’t fail or drop out of college because they have a low IQ. It is because they have unaddressed emotional deficiencies, and our company solves that problem for college students and professionals in the workplace.

As a leader in soft skills training, what do you believe are the most crucial soft skills for individuals and organizations in today’s professional landscape?

There are so many necessary soft skills that it’s hard to rank them because everyone is different. It’s like asking, “What are the three best foods for your body?” or “What is the best book to read?”. It all depends on the individual. That’s why we offer pre-assessments to all our clients because it helps craft an individualized learning plan specific to the person’s needs. Some new employees need to focus on Time Management, while others need Self-Regulation or Managing Stress. The best part about the platforms we develop is they are NOT one size fits all. We all have different needs and are at different stages of emotional development, which is why our platforms are designed to accommodate the soft skills needs of each participant.

Success Training Institute (www.simplysuccess.com) provides customized learning platforms. How do you ensure that these platforms cater to the diverse needs of your clients, including colleges, corporations, and individuals?

It all starts with communicating with our clients and understanding what they want to accomplish. For some, it’s student or employee retention. For the colleges that have access to resell our training programs under its brand, fundraising may be the focus. Once we have an initial consultation, our team of experts customizes video commercials, organizes lesson material, and adds analytics to track and monitor the key data points. We are the only company that offers our clients a tailor-made soft skills training experience, and it’s one of the features that makes us unique in this industry.

In your view, how does soft skills training contribute to organizational efficiency, and what tangible improvements have you observed in companies that have implemented your programs?

First, soft skills are going to make organizations more productive. Remember, when we master our emotions, we become better people, which makes us better at everything we do. Organizations don’t have to hire new people because the Success Training Institute helps the people they have become even better. For college students, increased productivity means better grades. For the sales professional, it means more closed deals. Better people are always more productive. Next, we see strong gains in retention. The biggest challenge in the workplace is turnover. Our soft skills programs boost confidence, competencies, and individual satisfaction, all contributing to employees staying on jobs longer. Last but certainly not least, we see the gains in revenue. Turnover is expensive for every organization. Our programs have been proven to reduce by as much as fifty percent! That’s literally putting money back into the pockets of our clients.

What challenges do you perceive in the current landscape of employee development, and how does Success Training Institute address these challenges?

The remote workforce is growing rapidly and is changing the way we see a typical workday. It can also have adverse emotional impacts. When people don’t connect interpersonally, they lose a valuable skillset our company helps restore. Remote work is also changing the way people want to learn. Most are turned off by live training sessions that confine them to crowded conference rooms for several hours daily. They want training to adjust to their lifestyles. Our programs are mobile-friendly, video-based, and self-paced because that is the future of learning. Each lesson is 8 minutes or less because the adult attention spans are shrinking. Companies that don’t recognize these trends will lose employees in droves. Back in the day, employees adjusted to the workforce. Today, the workforce has to adjust to the employee, including training and development.

Could you elaborate on the Virtual Internship Programs offered to college students? How do these programs bridge the gap between academic learning and real-world professional skills?

Our virtual internship programs are second to none because they offer the best of all worlds. First, college students get to work remotely. Next, they gain soft skills and hard skills. Last but certainly not least, they get paid! They apply online, interview online, and are assigned a virtual supervisor. They can work in our Marketing, Content Creation, IT, Sales, or Administrative departments, which gives them real-world experience that accommodates the demands of their collegiate schedules. Many colleges are located in small towns where internship opportunities are limited. Our programs allow them to complete project-based assignments from anywhere in the world without the hassle of long commutes or the cost of new wardrobes.

The success of STI’s training is often highlighted by its quick impact on productivity and positivity. Can you share some insights into the unique instructional methods or strategies that contribute to this rapid improvement?

Two terms are important when answering this question. Pedagogy and Heutagogy. The first is the one we are most familiar with in traditional education. This is highly structured learning where students enter a classroom and are taught by one or more instructors. Everyone must learn the same thing at the same time. No exceptions. On the contrary, heutagogy is self-directed learning, which allows participants to learn based on need, interest, and other learning preferences. Most online training programs are pedagogical and shouldn’t be because that methodology is most effective in organized classroom settings. We developed heutagogical learning model called the SIPS Instructional Method. It is proven, practical, and powerful. Those who engage in our online courses see measurable gains in crucial soft skills in less than 8 minutes per lesson per day. The content is relevant and appeals to various types of learning preferences. There is a short quiz after each lesson to gauge retention, and our model has the highest user engagement rates in the industry.

As a Top Innovator in Education Technology, how do you envision the future of online training, especially in the context of soft skills development? What advice would you give entrepreneurs, HR professionals, and individuals looking to enhance their soft skills and stay competitive in today’s dynamic business environment?

I recently met one of the most accomplished and respected business leaders in the United States at a reception. During our conversation, he quickly said that Soft Skills ARE the new Hard Skills. He pointed out what he had observed over his many years in business and added that small, private colleges and universities need viable soft skills partnerships to remain relevant in the years to come. Of course, I wholeheartedly agree. For entrepreneurs, HR professionals, and business leaders across all industries would be well served to place soft skills in their rightful place: the most important skillset any professional can acquire. In a time where emotional health and wellness are more prominent than ever, we cannot overlook the importance of soft skills any longer. We are fortunate to be in the right place at the right time.